May 26, 2017 (IN10709)

|R. Eric Petersen, Specialist in American National Government

Congress enacted the President John F. Kennedy Assassination Records Collection Act of 1992 (JFK Records Act), as amended, to bring together all materials related to the November 22, 1963, assassination of the 35th President that were created or held by a government office, and to house those records in a single collection in the National Archives and Records Administration (NARA). Today, NARA reports that there are 268,116 records comprising more than five million pages of paper documents in the President John F. Kennedy Assassination Records Collection. Of those, NARA states that “approximately 88% of the records … are open in full.” Another 11% are available in part with sensitive portions removed. Approximately 1% of documents identified as assassination-related, numbering between 3,000 and 3,600 records according to some media reports, remains withheld in full.

The JFK Records Act, 44 U.S.C. 2107 Note, set a deadline of 25 years from its enactment for each assassination record to be publicly disclosed, subject to some limitations. The deadline falls on October 26, 2017, and has raised some interest about the potential extent of disclosure of redacted portions of records that are partially available, and those that are withheld in full. No legislation related to the JFK Records Act has been introduced in the 115th Congress.

The October 26 deadline marks the end of the final, statutorily mandated assessment of assassination records, and might mark the conclusion of a long process of records preservation and assessment for the suitability of their release that began in the days and weeks following President Kennedy’s death. The JFK Records Act prohibited the destruction or alteration of assassination records, and required each government office, including Congress, various investigatory commissions and panels, executive branch entities, independent agencies, courts, and involved state or local law enforcement agencies, to identify and organize its assassination records, determine which were officially disclosed or publicly available in a complete, unredacted form, and which were covered by the Act’s standards for postponement of public disclosure. Officially disclosed records were to be made available immediately in 1992, following enactment of the JFK Records Act.

Postponed records were to be submitted to the Assassinations Records Review Board, an independent agency established by the JFK Records Act. The Review Board was to be composed of impartial private citizens with national professional reputations in their fields appointed by the President with the advice and consent of the Senate. The Review Board’s responsibilities were to determine whether a record constituted an assassination record and whether an assassination record or particular information in a record qualified for postponement of disclosure.

Grounds for postponement include:

- Threats to military or intelligence operations or the foreign relations of the United States.

- Undisclosed intelligence sources or methods.

- Potential identification of intelligence agents whose identities require protection.

- Identification of a living person who provided confidential information who would be at risk of harm.

- Unwarranted invasion of personal privacy.

- Compromising confidentiality requiring protection between a government agent and a cooperating individual or a foreign government.

- Public disclosure of a security or protective procedure currently utilized by the Secret Service or other government agency responsible for protecting government officials.

The Review Board concluded its duties on September 30, 1998, and transferred its records to NARA. In its final report, the Review Board stated that it had reviewed and voted to release more than 27,000 previously redacted assassination records, and worked with various agencies to publicly release more than 33,000 of their previously restricted assassination records. All remaining postponed records have been subject to periodic review by the agency originating a postponed record and NARA. When a record is determined to qualify for continued postponement, an unclassified written description of the reason must be provided and published in the Federal Register.

The Review Board concluded its duties on September 30, 1998, and transferred its records to NARA. In its final report, the Review Board stated that it had reviewed and voted to release more than 27,000 previously redacted assassination records, and worked with various agencies to publicly release more than 33,000 of their previously restricted assassination records. All remaining postponed records have been subject to periodic review by the agency originating a postponed record and NARA. When a record is determined to qualify for continued postponement, an unclassified written description of the reason must be provided and published in the Federal Register.

In anticipation of the October 26, 2017, deadline, NARA in 2014 established a team of archivists and technicians to evaluate materials subject to postponed disclosure and to process those materials for public release, along with an explanation of their activities. NARA reports that it has “identified a small number of records, or portions of records” related to grand jury or personal tax return information, and some records subject to a deed of gift that restricts their disclosure, that will not be released in October. As of March 2017, NARA states that it has not been informed of any agency appealing the planned release of its documents, but their understanding is “that agencies are still reviewing the documents subject to release.”

Under the JFK Records Act, postponed agency assassination records are scheduled to be released on October 26, 2017, unless the President certifies before then that continued postponement is made necessary by an identifiable harm to the military defense, intelligence operations, law enforcement, or conduct of foreign relations, and that the harm is of such gravity that it outweighs the public interest in disclosure. There is no publicly available, authoritative source describing the contents of redacted and withheld records, but NARA states their assumption “that much of what will be released will be tangential to the assassination events.”

DOWNLOAD a PDF of this article HERE.

RELATED: FREEING THE JFK FILES

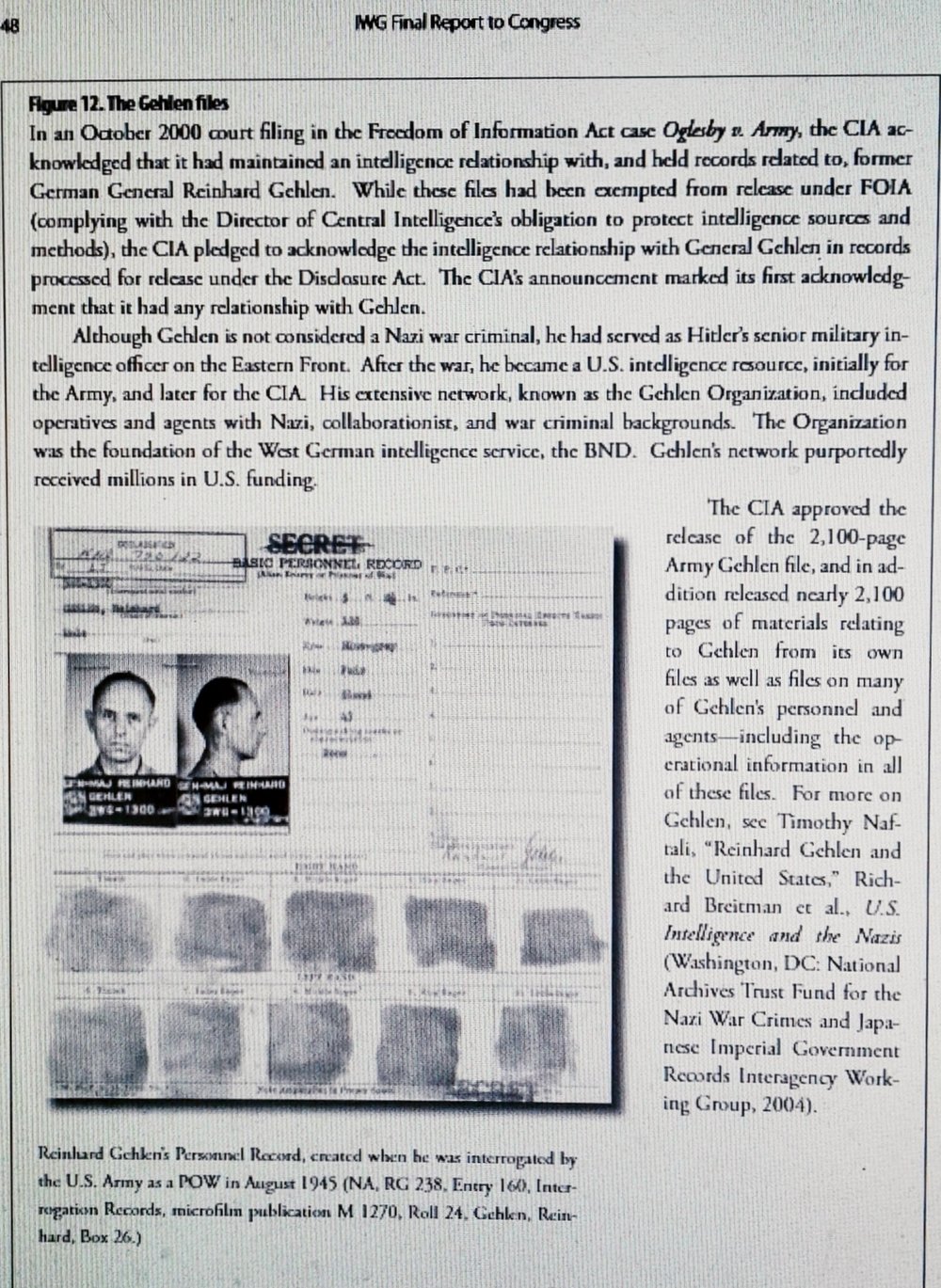

This final element of the Odessa was the so-called Gehlen Organization (the Org), the Nazi intelligence system that sold itself to the U.S. at the end of the war. It was by far the most audacious, most critical, and most essential part of the entire Odessa undertaking. The literature on the Odessa and that on the Gehlen Organization, however, are two different things. No writer in the field Of Nazi studies has yet explicitly associated the two, despite the fact that General Reinhard Gehlen was tied politically as well as personally with Skorzeny and Schacht. Moreover, Gehlen’s fabled post-war organization was in large part staffed by SS Nazis who are positively identified with the Odessa, men such as the infamous Franz Alfred Six and Emil Augsburg of the Wannsee Institute. An even more compelling reason for associating Gehlen with the Odessa is that, without his organization as a screen, the various Odessa projects would have been directly exposed to American intelligence. If the Counter Intelligence Corps (CIC) and the Office of Strategic Services (OSS) had not been neutralized by the Gehlen ploy, the Odessa’s great escape scheme would have been discovered and broken up.

This final element of the Odessa was the so-called Gehlen Organization (the Org), the Nazi intelligence system that sold itself to the U.S. at the end of the war. It was by far the most audacious, most critical, and most essential part of the entire Odessa undertaking. The literature on the Odessa and that on the Gehlen Organization, however, are two different things. No writer in the field Of Nazi studies has yet explicitly associated the two, despite the fact that General Reinhard Gehlen was tied politically as well as personally with Skorzeny and Schacht. Moreover, Gehlen’s fabled post-war organization was in large part staffed by SS Nazis who are positively identified with the Odessa, men such as the infamous Franz Alfred Six and Emil Augsburg of the Wannsee Institute. An even more compelling reason for associating Gehlen with the Odessa is that, without his organization as a screen, the various Odessa projects would have been directly exposed to American intelligence. If the Counter Intelligence Corps (CIC) and the Office of Strategic Services (OSS) had not been neutralized by the Gehlen ploy, the Odessa’s great escape scheme would have been discovered and broken up.

In Veciana’s presentation at Bethesda he says the Dallas encounter happened because he had arrived 15 minutes early at the location. Nothing is mentioned about this in the book. Again, given what he says about Phillips dressing him down severely when he made tradecraft mistakes, how does this violation of tradecraft go uncommented upon if it happened that way?

In Veciana’s presentation at Bethesda he says the Dallas encounter happened because he had arrived 15 minutes early at the location. Nothing is mentioned about this in the book. Again, given what he says about Phillips dressing him down severely when he made tradecraft mistakes, how does this violation of tradecraft go uncommented upon if it happened that way?